- Apr 2, 2009

- 5,171

- 13,288

- 66

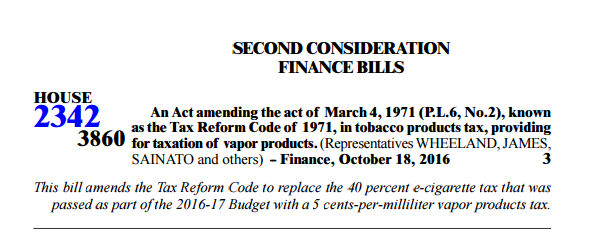

HB 2342 has been scheduled for a vote in the PA House floor vote today (to change PA's disastrous 40% vapor tax to a $.05/ml tax on nicotine e-liquid) after being approved by the House Finance Cmte several weeks ago.

PA General Assembly

http://www.legis.state.pa.us/WU01/LI/SC/HC/0/RC/CAL.PDF?r=1476801002967

To watch PA House session live, go to:

House Session Live

If you live in PA, please contact your PA State Representative NOW (at Harrisburg office) urging him/her to vote for HR 2342, sponsored by Rep. Jeff Wheeland.

Bill Information - House Bill 2342; Regular Session 2015-2016

Contact information for PA Representatives is at:

Members of the House

Find Your Legislator

Smokefree Pennsylvania sent the following letter to members of the PA House of Representatives.

Via Fax October 17, 2016

The Honorable Mike Turzai

Pennsylvania House Speaker

Harrisburg, PA 17120

RE: Change vapor tax to improve public health, reduce state spending, save businesses and jobs

Dear Representative Turzai:

Please support HB 2342 introduced by Rep. Jeff Wheeland to change the disastrous 40% tax on lifesaving vapor (i.e. e-cigarette) products to a $.05/ml tax on nicotine containing liquid in vapor products.

As we previously warned you, the 40% tax on vapor products (approved by the PA General Assembly as part of the budget) has already caused more than 60 vape shops in PA to go out of business, reducing PA income and sales tax revenue (instead of generating vapor tax revenue).

Vapor products have already helped more than 100,000 cigarette smokers in PA quit smoking, including thousands of Medicaid recipients, saving PA and US taxpayers tens of millions of dollars that would otherwise be spent treating cigarette diseases. A recent study found that PA Medicaid expenditures for treating cigarette diseases were $2.24 Billion in 2012, and that 70% of PA’s 2.44 million Medicaid enrollees were cigarette smokers.

http://www.statebudgetsolutions.org...oised-to-save-medicaid-billions#ixzz3W1JxiUUP

In sharp contrast to selfish crony capitalist claims made by groups that lobbied for the 40% vapor tax (i.e. Big Pharma funded CTFK, ACS, AHA, ALA, etc.) to protect nicotine gum and patch markets from market competition, the scientific and empirical evidence has consistently found vapor products are >95% less harmful than cigarettes, have helped millions of smokers quit smoking and/or sharply reduce cigarette consumption, have not addicted nonsmoking teens, and pose no risks no nonusers.

The $.05/ml tax on nicotine e-liquid in HB 2342 will generate a similar level of PA vapor tax revenue (that the PA Dept of Revenue estimated would be generated by the 40% vapor tax) without putting vapor companies in PA out of business, without reducing jobs, and without reducing PA income and sales tax revenue.

Once again, please support HB 2342.

Sincerely,

Bill Godshall

Executive Director

PA General Assembly

http://www.legis.state.pa.us/WU01/LI/SC/HC/0/RC/CAL.PDF?r=1476801002967

To watch PA House session live, go to:

House Session Live

If you live in PA, please contact your PA State Representative NOW (at Harrisburg office) urging him/her to vote for HR 2342, sponsored by Rep. Jeff Wheeland.

Bill Information - House Bill 2342; Regular Session 2015-2016

Contact information for PA Representatives is at:

Members of the House

Find Your Legislator

Smokefree Pennsylvania sent the following letter to members of the PA House of Representatives.

Via Fax October 17, 2016

The Honorable Mike Turzai

Pennsylvania House Speaker

Harrisburg, PA 17120

RE: Change vapor tax to improve public health, reduce state spending, save businesses and jobs

Dear Representative Turzai:

Please support HB 2342 introduced by Rep. Jeff Wheeland to change the disastrous 40% tax on lifesaving vapor (i.e. e-cigarette) products to a $.05/ml tax on nicotine containing liquid in vapor products.

As we previously warned you, the 40% tax on vapor products (approved by the PA General Assembly as part of the budget) has already caused more than 60 vape shops in PA to go out of business, reducing PA income and sales tax revenue (instead of generating vapor tax revenue).

Vapor products have already helped more than 100,000 cigarette smokers in PA quit smoking, including thousands of Medicaid recipients, saving PA and US taxpayers tens of millions of dollars that would otherwise be spent treating cigarette diseases. A recent study found that PA Medicaid expenditures for treating cigarette diseases were $2.24 Billion in 2012, and that 70% of PA’s 2.44 million Medicaid enrollees were cigarette smokers.

http://www.statebudgetsolutions.org...oised-to-save-medicaid-billions#ixzz3W1JxiUUP

In sharp contrast to selfish crony capitalist claims made by groups that lobbied for the 40% vapor tax (i.e. Big Pharma funded CTFK, ACS, AHA, ALA, etc.) to protect nicotine gum and patch markets from market competition, the scientific and empirical evidence has consistently found vapor products are >95% less harmful than cigarettes, have helped millions of smokers quit smoking and/or sharply reduce cigarette consumption, have not addicted nonsmoking teens, and pose no risks no nonusers.

The $.05/ml tax on nicotine e-liquid in HB 2342 will generate a similar level of PA vapor tax revenue (that the PA Dept of Revenue estimated would be generated by the 40% vapor tax) without putting vapor companies in PA out of business, without reducing jobs, and without reducing PA income and sales tax revenue.

Once again, please support HB 2342.

Sincerely,

Bill Godshall

Executive Director